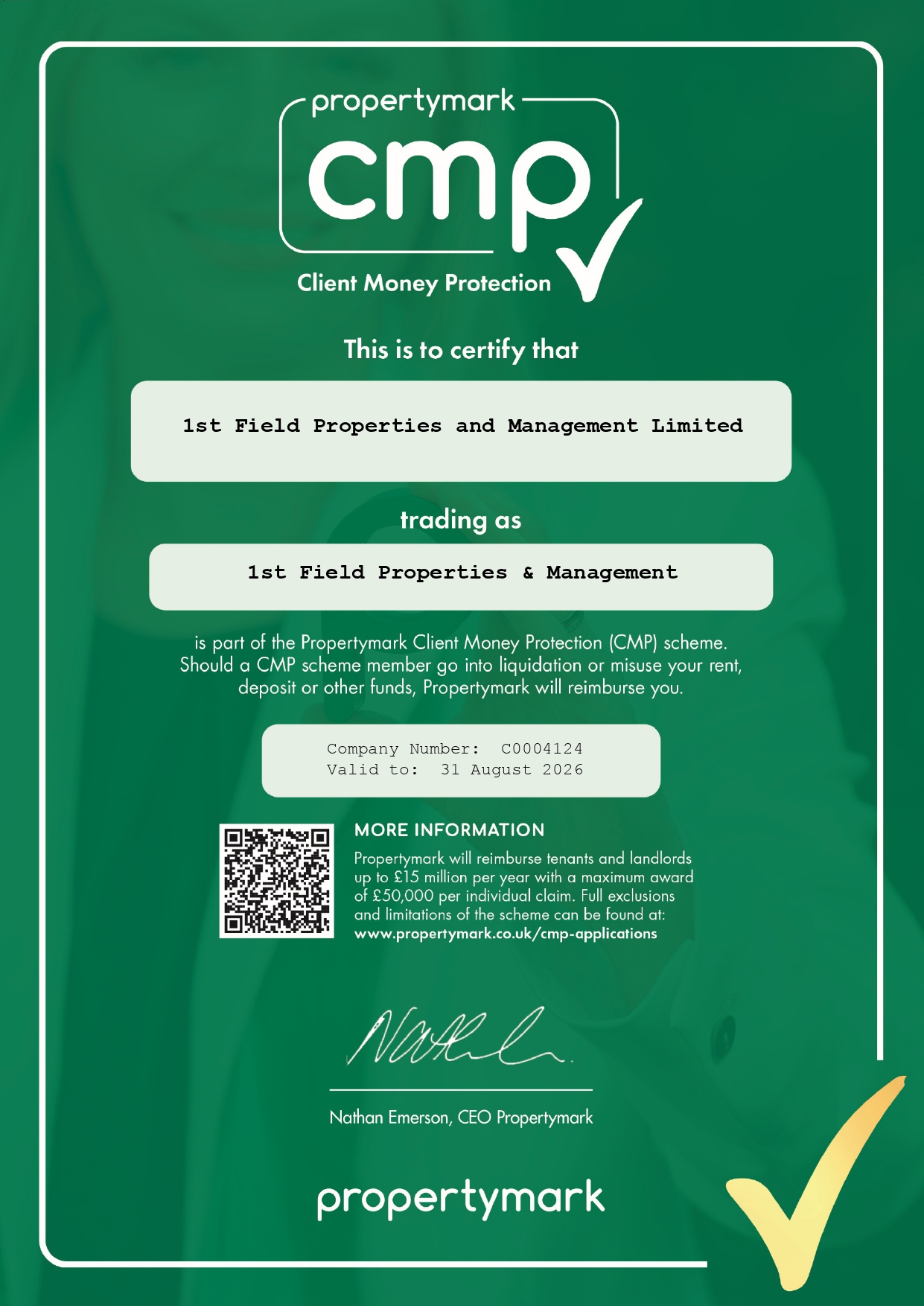

CMP CERTIFICATE

CONDUCT RULES FOR ALL PPD MEMBERS

1. Accounting Rule (This rule does not apply to members of ARLA Inventories)

Members’ firms that are regulated by the Royal Institution of Chartered Surveyors (RICS), the Law Society or the Law Society of Scotland are exempt from the requirements of this rules.

1.1. Introduction to the Accounting Rule

1.1.1. The principles of this Rule shall apply to any PPD member’s firm that holds or handles Client Money or that has a contract with a Client and then outsources the Client Accounting to another organisation/legal entity.

1.1.2. These rules and the annexed Accountant’s Report or Accountant’s Report for Client Money Entrusted to an Unnamed Client Accounting Service Provider define the minimum level of accounting control required by a PPD where Clients’ funds are transacted by the business of that member. It is presented in a manner that anyone with a rudimentary knowledge of bookkeeping will find easy to comprehend. If complied with, it should be impossible for a member to confuse Clients’ Money with their own, or inadvertently to make improper payments.

1.1.3. In a partnership or company, all partners or directors share the responsibility of maintaining a proper bookkeeping system. Any misappropriation or error by one partner, director or a member of staff is the responsibility of every principal, partner or director. It is therefore incumbent upon all principals, partners and directors to satisfy themselves that any breach in the rules is rectified immediately.

1.2. Interpretation and definitions of some key terms used in Client Accounting

Accountant A suitably qualified or authorised person as detailed in clauses 1.24 and 1.25 of this Rule.

Accountant’s report The annual form duly completed and signed by the Accountant and provided to Propertymark.

Bank The Bank of England, the Post Office (in the exercise of its powers to provide banking services) or an authorised institution that has permission to accept deposits under the Financial Services and Markets Act 2000.

Building society As defined in section 119(1) of the Building Societies Act 1986 and is an authorised institution that has permission to accept deposits under the Financial Services and Markets Act 2000.

Client Any person or body for whom the PPD member’s firm or Client Accounting Service Provider holds or receives Clients’ Money (which may include a landlord or tenant, purchaser, vendor or contractor); including past, present and prospective Clients.

Client Accounting Service Provider (CASP)

A PPD member’s firm that manages Client Money on behalf of another PPD member’s firm. See clause 1.3 for a fuller definition.

Client (Bank) Account(s) A suitably designated and recognised current or deposit account at a bank or building society into which Clients’ Money is paid or transferred. (See clause 1.9 of this Rule.) (Sometimes called a pooled Client Bank Account.)

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 7

Client’s ledger Documents, journals, file cards, printouts – handwritten or mechanical or computer generated – which comprise a permanent chronological record of transactions and balances for an individual Client, at any time.

Clients’ Money Any money received or held by a member or PPD member’s firm or its Client Accounting Service Provider to which they are not beneficially entitled and over which there is exclusive control. See Clause 1.10 of this Rule for a more detailed definition.

Connected person/associate

A person is an associate of another if he or she is the spouse or a relative of that other or a business associate of that other. A relative is a brother, sister, uncle, aunt, nephew, niece, lineal ancestor or lineal descendant. References to a spouse include a former spouse and a reputed spouse. For the purposes of this subsection a relationship shall be established as if an illegitimate child or step-child of a person had been a child born to him or her in wedlock.

Office Account Any normal trading, business or office bank account opened or maintained by the member in which are held, or transferred, funds belonging to the member and/or from which outgoings incurred or due from the member, are paid; as distinct and separate from a Client Bank Account.

Payment(s) Any type or style of disbursement, withdrawal or transfer from a Client Bank Account.

PPD Member’s firm Firm (legal entity) under the control of any principal, partner, or director who is a member of ARLA Propertymark, NAEA Propertymark, NAVA Propertymark, ARLA Inventories or NAEA Commercial.

Principal Agent (PA) The firm or firms named in the contracts with the Client.

Reconciliation An analysis that identifies, on a given date, any differences between balances on Client ledgers against sums held in the Client Bank Account(s) and the Client Account Cash Book.

Records All documentation relating to the necessary operation and monitoring of the accounting/bookkeeping process in compliance with the rules of membership (including any bye-laws, rules of conduct, codes of practice including appendices of ARLA Propertymark, NAEA Propertymark, NAVA Propertymark, or NAEA Commercial).

1.3. Using a Client Accounting Service Provider (CASP) PPD member firms wishing to use a CASP are required to adopt one of the following two options: • Use a named CASP (see 1.3.1), or • Use a white label CASP service (see 1.3.2).

1.3.1. Use a named CASP. The following conditions apply:

(a) The CASP is a PPD member firm (excluding ARLA Inventories) or a RICS regulated firm where Propertymark receives written assurances from RICS that all Client Money is covered. (b) All Client Monies are paid direct to the Client Account(s) owned by the CASP.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 8

(c) All terms of business, landlord and tenancy agreements must clearly identify the legal names of the Principal Agents. (d) All terms of business, landlord and tenancy agreements must clearly identify the legal name of the CASP in all references to Client Money. (e) The CASP is the only firm to be able to make payments/withdrawals from the Client Account(s). (f) The CASP provides Propertymark with a standard annual accountant’s report for ALL the Client Money it handles. See Appendix A of the rules. (g) Both Principal Agents pay the Propertymark CMP levy.

In this way the CASP has exclusive control of the Client Account, and all Clients know who is handling their money. Liability to Clients remains with the CASP, and not with the firm using the CASP. This then constitutes first party Client Accounting by the CASP.

1.3.2. Use an unnamed CASP service. The following conditions apply:

(a) The CASP is a PPD member firm or a RICS regulated firm. (b) All Client Monies are paid direct to the Client Account(s) owned by the CASP. (c) The CASP is not clearly named in terms of business, landlord and tenancy agreements. (d) The legal name of the firm using the CASP (the Principal Agent) is clearly stated in terms of business, landlord and tenancy agreements. (e) All Client Monies are paid into a separate Client Account(s) designated to the PA PPD member firm, and owned solely by the CASP. (f) The CASP is the only firm to be able to make payments/withdrawals from the Client Account. (g) The PA and CASP both pay the Propertymark CMP levy. (h) The PA maintains records of all Client Monies in accordance with the relevant Propertymark rules. It may rely on schedules and reconciliations from the CASP but these should be kept in paper form. (i) The PA PPD member firm provides Propertymark with an Accountant’s Report for Client Money Entrusted to an Unnamed Client Accounting Service Provider on joining or on taking up the Client accounting service, and annually thereafter. See Appendix A to the rules. The report may be commissioned by the PA or CASP, but it remains the responsibility of the PA to provide it to Propertymark.

1.3.3. Any member’s firm acting as a CASP as outlined in 1.3.2 must meet the following requirements:

(a) Keep any such Client Money in a Client Account specifically designated to each PA for whom it handles Client Money. (b) Supply the PA with a copy bank statement from the Client Bank Account at least monthly. (c) Not limit the liability of the CASP to its PAs, or if there is any limitation it is, as a minimum, at least the amount the PA has entrusted to it. (d) Allow a suitably qualified Accountant to audit the CASP in respect of Client Money held on behalf of the PA.

1.3.4. PPDs with member firms using a CASP where the arrangements do not comply with one of the CASP options described in 1.3 must take one of the following actions in order to continue with their divisional membership:

(a) Change their Client Money-handling arrangements in line with one of the CASP options described in 1.3, or

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 9

(b) Find another CASP which complies, or (c) The member’s firm must handle all of its own Client Money.

1.3.5. Client Money subject to the Estate Agents Act 1979 must not be entrusted to a CASP.

1.4. General

Propertymark reserves the right to waive or modify, with or without conditions, in any particular case, the requirements and/or general provisions of this Rule.

1.5. Provision of this Rule to relevant staff and the reporting Accountant

It is the duty and responsibility of PPD members that this Rule is readily available to and understood by all principals, partners and directors etc. of a PPD member’s firm and, most essentially, by any staff responsible for operating the accounting process and procedures of that firm. A copy of this Rule together with Appendix A must be provided to the reporting Accountant prior to beginning an examination.

Member Firms must publish their client money handling procedures on their company website and, upon request, make hard copies available, free of charge, to all customers. To meet this obligation the following link to the Propertymark Conduct and Membership Rules, http://www.propertymark.co.uk/media/1045366/conduct-and-membership-rules.pdf should be added to the Member Firms website. The annual Accountant’s Report will require confirmation that this Rule has been met.

1.6. Key elements

1.6.1. The relevant membership division requires its members to comply with these rules in respect of their Client Accounts to ensure that Clients’ Money is protected. The key basic elements that must apply to Clients’ Money entrusted to a PPD member’s firm are as follows:

(a) Each transaction must be properly recorded in the PPD member’s firm’s books/ledgers of account (paper, electronic or otherwise) so that it is clearly identifiable to an individual Client. (b) Monies must be paid into a specifically designated Client (Bank) account with a recognised bank or building society and thus kept separate from the member’s firm’s own money. (c) All transactions must be monitored and reconciled on a regular basis.

1.6.2. Client (Bank) Accounts must be properly designated (see clause 1.9 below), easily identifiable and the individual beneficial owners of any money contained therein should be attributable, without difficulty, for the following main reasons:

(a) To prevent a bank or building society offsetting a credit balance in one account against a debit or charge incurred by another. (b) To enable a receiver or liquidator or other investigator to identify money that does not belong to the member or their business. (c) To allow such accounts to easily be monitored and reconciled both internally and externally to demonstrate the financial integrity of the member and to ensure the smooth running of its accounting practices.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 10

1.7. Access to, or availability of, Client Money

A member must ensure that, at all times, all Client Money is held in Client Bank Accounts and is available on demand to Clients without undue delay or penalty. (For the avoidance of doubt, Client Money must not be placed or held in off-shore accounts or fixed/variable rate term bonds or similar funds or arrangements, unless the bank or building society falls within the definitions in 1.2, funds are available on demand and any penalty for withdrawal is paid by the member’s firm.)

Note: Any penalty for withdrawal of Client Money must be limited to interest earned.

1.8. Client Money from members’ properties

A member must not conduct personal or office transactions through a Client Bank Account, save that it shall be permissible for the member to manage and collect rent on a property or properties belonging to any principal, partner, or director of the firm, so long as the number of properties involved are de minimis (no more than 5%), declared to and so recorded by the Accountant while completing the annual audit. It is permissible to hold tenants’ deposit monies relating to such properties in a Client (Bank) Account. This clause must be read in conjunction with clauses 1.10.2 and 1.11.1.

1.9. Title and conditions of a Client (Bank) Account

1.9.1. All members who receive, or may receive, deposits in transactions to which the Estate Agents Act 1979 applies shall open and operate a distinct Clients’ Account for that purpose in accordance with the requirements of that Act and with the Regulations made under it.

1.9.2. A PPD member’s firm that receives or holds Client money must maintain at least one Client (Bank) Account for this purpose.

1.9.3. Any such account(s) must include both the word “Client” and the legal name of the Principal Agent or CASP in the title.

1.9.4. The PPD member’s firm must hold on file in its records, written confirmation from any bank or building society where a Client (Bank) Account is held, that the following conditions apply to any such account(s):

(a) All money held in the account is Clients’ Money; and (b) The bank or building society is not entitled to combine the account with any other account or to exercise any right of set-off or counter claim against money in that account in respect of any sum owed to it on any other accounts of the member or the member’s firm.

1.10. Clients’ Money

Clients’ Money shall include the following:

1.10.1. Any money received or held by a member or PPD member’s firm or its Client Accounting Service Provider to which they are not beneficially entitled and over which there is exclusive control.

1.10.2. Money held in respect of properties owned jointly by a principal, or one or more partners, or directors, together with a person who is not a co-principal, co-partner or director of the member’s firm. (The member’s firm is considered a trustee for such money, which must be paid into a Client Bank Account.)

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 11

1.10.3. Payments or lodgements in respect of fees and/or disbursements received before these have been earned or incurred by the member’s firm, or passed on to a third party.

1.10.4. Tenants’ deposits passed to a Tenancy Deposit Scheme operating a custodial option under the provisions of the Housing Act 2004 in England and Wales and the Housing (Scotland) Act 2006 and the relevant regulations for such schemes. Examples of Client Money may include:

(a) Tenants' deposits (b) Rents (c) Interest (if in an interest-bearing Client Account), but see 1.12. (d) Arbitration fees (e) Fee money taken in advance (f) Clients' Money held but due to be paid to contractors (g) Money held by members appointed as a Receiver (h) Sale proceeds (i) Purchase deposits (j) Other money which is held on behalf of any Client related to the normal business of estate agency, letting agency, business agency, auctioneering and property management but excluding any money held for or in connection with investment, saving, banking, conveyancing or any mortgage.

1.11. Clients’ Money does not include the following:

1.11.1. Money (other than tenants’ deposits) received in respect of properties wholly owned by a principal, or by one or more partners or directors of the member’s firm.

1.11.2. Money held in an account from which a particular Client can separately make withdrawals and so over which the member’s firm does not have exclusive control. In the rare circumstances where such accounts are operated, the member’s firm must promptly confirm to the Client in writing (and retain a copy) that:

(a) The account is not a Client Account; (b) Such money is not covered by the Client Money Protection Scheme; and (c) The account is not monitored as part of the Client accounting compliance procedures.

1.11.3. For the purposes of Propertymark client account reporting, service charges and other client monies collected for block management and/or holiday let purposes are excluded. Client Money held for block management and/or holiday let activities are not regulated by Propertymark.

1.12. Interest on Clients’ money

1.12.1. A member’s firm may enter into an arrangement, which must be in writing (for example via terms of business, tenancy agreement, letter of engagement, pretenancy application documents or similar), with a Client (landlord or tenant) that allows the member’s firm to retain interest earned on money held on a Client’s behalf. (Such written arrangements/documents shall constitute part of the records as defined in this Rule.) Where no such arrangement exists, any interest earned belongs to the relevant Client.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 12

1.12.2. Subject to clause 1.12.1 above, where interest is credited to Client Bank Accounts of a member’s firm, the Client Account(s) should be organised in such a way that the member’s firm is able to account to each individual Client for the amount of interest earned or due to them.

1.12.3. A member’s firm holding Clients’ Money (in this context, tenancy deposit bonds) as stakeholder during a tenancy, is entitled to retain any interest that may accrue to such money (Potters vs. Loppert 1973), providing this entitlement is made known to the relevant Client(s), in writing, from commencement; i.e. in line with clause 1.12.1 of this Rule.

1.13. Payments into a Client (Bank) Account

Payment of money into a Client Bank Account is restricted to the following:

1.13.1. The minimum sum required to open or maintain the Client Bank Account;

1.13.2. Clients’ Money (see clause 1.10);

1.13.3. An amount required to be paid by a member’s firm to restore in whole or part any money paid out, or withdrawn, in contravention of this Rule;

1.13.4. A cheque or bank draft that includes Clients’ Money as well as other money.

1.14. Payments out of a Client (Bank) Account

A member’s firm should withdraw, transfer or make a payment from a Client Bank Account only in the following circumstances:

1.14.1. Money paid in to open or maintain the account in accordance with clause 1.13.1 of this Rule and where it is no longer required.

1.14.2. Money paid into the account in accordance with clause 1.13.4 of this Rule, which does not belong to the Client, for payment to the person lawfully entitled to it.

1.14.3. Within three working days of becoming aware of a relevant contravention, money paid into the account in contravention of this Rule.

1.14.4. Money payable to a Client, or, to an appropriate person suitably authorised (in writing) to receive such payments on that Client’s behalf.

1.14.5. Money being paid directly into another Client Bank Account.

1.14.6. Reimbursement of money to the member’s firm for money expended by the member‘s firm on behalf of the Client.

1.14.7. Money lawfully and contractually due, in respect of a PPD member’s firm’s fees and charges.

1.14.8. Legitimate disbursements, e.g. amounts subject to invoices, costs or demands incurred or received on behalf of the Client.

1.14.9. Provided that in the case of money drawn under sub-clauses 1.14.6 and 1.14.7 above:

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 13

(a) The payment is in accordance with lawful and contractual written arrangements (for example via terms of business, pre-contract/tenancy application documents, tenancy agreement, letter of engagement), previously agreed between the parties; or (b) The Client, or an authorised representative, has been notified or invoiced in writing by the member’s firm of the amount and purpose for which the money is being withdrawn and no objection has been raised within a reasonable timescale.

1.14.10. Provided always that, under rule 1.14, no payment shall be made for or on behalf of an individual Client that exceeds the total amount held on behalf of that particular Client.

1.15. Timing of banking

1.15.1. A member’s firm must bank all receipts of Client Money into an appropriate Client bank account within a maximum of two working days from the day on which it was received.

1.15.2. All payments out of a Client bank account should be made promptly, and within not more than 1 calendar month of becoming due.

1.16. Methods of payment from a Client (Bank) account:

Payment from a Client (Bank) account may be made by:

1.16.1. A cheque;

1.16.2. An electronic transfer to another bank or building society account, provided that such an arrangement does not constitute a direct debit transaction;

1.16.3. A bank draft;

1.16.4. Cash (in exceptional cases and where sufficient (staff) safety and (financial) security measures can, in the opinion of the member’s firm, be taken for the holding of such money prior to payment; the handing over of such money and, where sufficient records of receipt are obtained upon collection of the money).

1.17. Signatories to payments from a Client (Bank) Account:

1.17.1. To avoid undue delays or inconvenience to Clients or others entitled to receive payments, during any absence from the business, the principal, partner or director member must make adequate provision for designated personnel to be able to authorise and/or make appropriate payments.

1.17.2. A member’s firm has a duty of care to ensure that appropriate controls exist around the ability of any individual(s) to make payments from a Client Bank Account, including making online payments, and must maintain an up-to-date and accurate record listing, as a minimum:

(a) The full names of such persons; and (b) Any limits or restrictions governing the amounts for which that individual is authorised either exclusively or, jointly with others; and (c) An example or specimen signature of each person.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 14

1.17.3. The original of such a list or schedule should be lodged with the relevant bank or building society used by the member’s firm and a copy retained within the records of the member’s firm.

1.18. Record keeping (firms using a CASP; see also 1.3.2)

Each member’s firm must keep properly detailed accounting records, using a bookkeeping system that is adequately designed and operated. Such records need to record:

1.18.1. All Clients’ Money received, held or paid out by the firm;

1.18.2. The amounts, dates, names, property addresses, reference numbers and other relevant details to identify individual transactions;

1.18.3. Any other money dealt with through a Client (Bank) Account, attributable to individual Clients;

1.18.4. An individual Client’s balance of monies held, and a balance of all Clients’ Money held.

1.19. Books of record

All dealings referred to in clauses 1.18.1 to 1.18.4 above shall be recorded as appropriate, either:

1.19.1. In a Clients’ cash book, or in a Client’s column of a cash book; or

1.19.2. In a journal recording transfers from the ledger account of one Client to that of another;

1.19.3. And, in either case, additionally in a Clients’ ledger or in a Client’s column of a ledger.

1.20. Supporting documentation

Records must include a list of all persons for whom a member’s firm is or has been holding Clients’ Money, reconciliation documents, and a list of all the bank and building society account(s) in which the money is held and must include counterfoils or duplicate copies of all receipts issued in respect of Clients’ Money received, which shall contain the particulars required to be shown in the accounts.

1.21. Preservation of records

The records kept for the purpose of complying with this Rule must be preserved for six years from the end of the accounting period to which they relate, or from when the account shows a nil balance following a cessation of the contractual relationship between the parties, whichever is the later. Propertymark recommends that a member’s firm consult with their Accountant before disposing of, or destroying, any historic accounting records.

1.22. Computerised recording

Where a computerised bookkeeping system is in operation, this must be capable of producing printed information to conform to this Rule, which therefore is or can be preserved in a permanent format to comply with clause 1.21.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 15

1.23. Reconciliation(s) – format and frequency

1.23.1. Every member’s firm shall:

(a) Ensure all monies due to member firm are removed prior to final reconciliations being undertaken. (b) At least once every two calendar months (and within no later than ten weeks of a previous reconciliation), reconcile the balance on their Client’s cash book(s): (i) With the balance in their Client Bank Account(s) using the bank/building society statement(s); and (ii) With the total of each Client’s balance in the Clients’ ledger; and (c) Ensure that such documents necessary to support the reconciliation so produced have been kept safe, complete and readily available in the cash book or other appropriate place.

1.23.2. All such reconciliations should be checked and signed by the PPD member of the company, or by such person formally appointed by the PPD, who shall not be the person responsible for the preparation of such reconciliation. (This could be a member of staff of the appointed reporting Accountant, provided this is carried out within ten working days of the reconciliation.)

1.23.3. Reconciliations must be stored so as to be readily available at audit or inspection, in accordance with 1.21.

1.24. Qualifications of Accountants

An Accountant is disqualified from making a report under this Rule if, at any time between the beginning of the accounting period to which the report relates and the completion of the report, the reporting accountant shall be a connected person to any principal, partner or director of the member’s firm (whether Principal Agent or CASP) or to any member of the staff employed by the member’s firm in the preparation of the Client Accounting records. The Accountant must be a member of a relevant professional body and, where the Client funds held are subject to the Estate Agents Act 1979 must be a registered auditor as per section 1239 of the Companies Act 2006.

1.25. Eligibility of Accountants

1.25.1. Where this clause does not conflict with clause 1.24 above, an Accountant is eligible and qualified to give an Accountant’s Report for the purposes of this Rule if he or she is a member of any of the following:

• Institute of Chartered Accountants in England and Wales • institute of Chartered Accountants of Scotland • Chartered Accountants Ireland • Association of Chartered Certified Accountants

and has a practising certificate from one of the aforementioned bodies, required to undertake such work, where applicable.

1.25.2. And also, if the agent carries out transactions regulated by the Estates Agents Act 1979:

• An individual who is a registered auditor within the terms of Section 1239 of the Companies Act 2006; or • An employee of such an individual; or

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 16

• A partner in or employee of a partnership that is a registered auditor within the terms of the Companies Act 2006; or • A director or employee of a company that is a registered auditor within the terms of the Companies Act 2006; or • A member or employee of a limited liability partnership under the Limited Liability Partnership Act 2000 that is a registered auditor within the terms of the Companies Act 2006.

1.26. Accountant’s report – timing and format (see clause 1.48)

Once in every period of twelve months each member‘s firm shall cause to be prepared and delivered to Propertymark an Accountant’s Report or Accountant’s Report for Client Money Entrusted to an Unnamed Client Accounting Service Provider on behalf of the member’s firm, as appropriate. (See Appendices A and B to the rules).

1.27. Submission of report or HealthCheck

The report referred to in this Rule must be submitted to Propertymark by the member’s firm no later than six months after the end of the accounting period to which it relates (if completing the HealthCheck, please ensure information is supplied to The Letting Partnership, allowing sufficient time to ensure the final report or HealthCheck is received by Propertymark in accordance with this rule).. Late submission of Accountant’s Reports may be pursued as a disciplinary matter. Such matters will be dealt with outside of the disciplinary procedures. In these circumstances members may not have an opportunity to explain the reasons for their delay. Instead, late submission is likely to result in an automatic fine of up to £200 per breach of every separate requirement. Failure to provide an Accountant’s Report within twenty eight days of the deadline will result in termination of all memberships of all PPD members responsible for the firm. This timescale may be altered with prior arrangement of Propertymark.

1.28. The relevant accounting period

The relevant accounting period:

1.28.1. Shall cover not more than twelve months*;

1.28.2. Shall begin at the expiry of the last preceding accounting period for which a report under this Rule has been submitted to the Propertymark; and

1.28.3. Shall, where possible, correspond to a period or consecutive periods for which the accounts of the member’s firm or CASP are ordinarily made up.

*Except where otherwise agreed by Propertymark (for instance, to allow for a change in yearend accounting date); in such circumstances Propertymark may at its discretion request additional information in order to be satisfied of the continuing compliance of the member’s firm.

1.29. Change of accounting period

A change of the accounting period of a member’s firm must be notified to Propertymark at least one month before the end of the originally notified accounting period.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 17

1.30. Reporting when no Client’s Money has been held

Where a member’s firm has a Clients’ Account or uses a CASP but no Client’s Money has been held during the relevant period, a report shall be completed, by the Accountant, to this effect.

1.31. Where a member is a PPD of more than one firm

Where a member is a principal, partner or director of more than one firm, a separate report for each firm must be submitted.

1.32. More than one place of business

Where a member’s firm has more than one place of business, one or more report(s) may be submitted in respect of the business, provided that the report(s) cover(s) all Clients’ Money held, received or paid out by the member’s firm.

1.33. More than one CASP

Where a member’s firm uses more than one CASP, then the requirements must be met for each CASP.

1.34. Accountant’s Report – scope and content

It is the duty of each member’s firm to provide to their Accountant at appropriate times (usually this would be both at the point of agreeing their terms of engagement and at the time of the audit visit):

1.34.1. An up-to-date copy of this Rule, together with

1.34.2. The Accountant’s Report (Appendix A), which must be submitted to Propertymark in due course with each page signed and dated by the reporting Accountant.

1.35. Special requirements

1.35.1. New PPD firms that have started trading with a Client (Bank) Account nil balance, and have not yet had an accounting year end, are required to submit immediately an Accountant’s Report. See Appendix A to the rules.

1.35.2. PPD member’s firms that begin to use an unnamed CASP as described at 1.3.2 are required to submit immediately an Accountant’s Report for Client Money Entrusted to an Unnamed Client Accounting Service Provider on behalf of the member’s firm.

1.35.3. New PPD applicants and current PPD members whose newly acquired company inherited a Client (Bank) Account balance, or whose company has already had an accounting year end, will need to submit immediately an Accountant’s Report for the company’s last financial year.

1.35.4. For business transfers, company purchases, or changes in company type, or if it is unclear what Client Account reporting is required, a PPD member must seek instruction from Propertymark.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 18

1.36. Client accounting compliance check visits and investigations

Reason/rationale for such visits/investigations: In order to comply with obligations placed on Propertymark under its Client Money Protection Scheme and its duty to both its own membership and the public to robustly monitor compliance with Accounting rules, Propertymark may, at any time, carry out or authorise a visit or inspection as part of the random spot checks carried out by Propertymark from time to time upon a member’s firm(s) or as a result of information coming to the attention of Propertymark.

1.37. Notification of such visits/investigations

The relevant selected member’s firm will be provided with at least a minimum of ten working days’ notice of the intention to carry out such a visit.

1.38. Duty to co-operate and provide information/records

It is a condition of membership that a member’s firm co-operates with such a visit or inspection and, in this regard, will be required to produce or make available, at a time and place duly notified, such records and documents (howsoever maintained or stored) as necessary for inspection and review by a person appointed by Propertymark, in order that a report on compliance may be produced. CASPs must ensure that their terms of business allow Propertymark access to their Client Account records for inspection visits or audit purposes.

1.39. Scope of visits

Such visits or investigations may or may not comprise an audit (insomuch as this term applies to compliance with this Rule) and may or may not be restricted to an assessment of the systems, procedures and controls operated by the member’s firm with regard to the Accounting rules.

1.40. Liability for costs of such visits/inspections

If, following such a visit or inspection carried out under this Rule, the member’s firm is found to have contravened or breached the relevant rules, Propertymark reserves the right to require the member’s firm to pay an amount, which shall be no more than the total costs, towards the expenses and/or expenditure incurred by Propertymark in carrying out such a visit and/or investigation. (For the avoidance of doubt, this amount shall be separate from any other fine or sanction imposed by the Propertymark or Disciplinary Tribunal for a contravention or breach of the rules.)

1.41. Ongoing liability to co-operate after membership ceases

Where membership ceases (for whatever reason) and Propertymark has cause to believe Propertymark may be, or may become, liable to a claim under the Propertymark Client Money Protection Scheme, that member and their firm shall have an ongoing liability to provide full access to the Propertymark or its representatives in relation to this Rule.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 19

1.42. Old or dormant Client balances

1.42.1. If a member’s firm has credit balances in its Client (Bank) Account(s) that represent money previously held for Clients who cannot now be traced or which cannot now be attributed to or identified as belonging to a particular Client, the member’s firm is not entitled to take that money, as it can never belong to the member’s firm. It represents funds entrusted to the member’s firm and would thus be a breach of trust to take a Client’s Money even where the member’s firm has tried and failed to trace and/or identify the relevant Client.

1.42.2. Such old/dormant funds should be transferred to and recorded in a suitably designated Client Suspense Account Ledger. (For the avoidance of doubt, any such account remains within the scope of this Rule and still subject to regular reconciliation and the year-end audit.)

1.43. Identifying ownership of old or dormant funds

1.43.1. A member’s firm must take reasonable steps to identify to whom the money belongs through their accounting and other records and this should include carrying out an extensive investigation of the audit trail; and,

1.43.2. In the case of an old or ex-Client for whom the member’s firm no longer acts; reasonable steps must be taken by the Principal Agent(s) to trace the Client, and this might include writing to: the last known place of residence; to the Client’s professional advisers (Solicitors, Accountants etc.); to the Client’s Bank or any other contacts (referees, guarantors, next of kin, employers etc.) provided within their file.

1.44. Donation of dormant funds to charity

Under exceptional circumstances, and following written explanation of: • The actions taken by the Principal Agent(s), and • The current situation and status of any investigations, and • Disclosure of the amount involved, and • Sufficient time (usually at least six years) having elapsed from last contact from the Client or activity on the relevant Client Ledger Account,

Propertymark may allow the old or dormant Client funds to be donated by the Principal Agent(s) to a suitable registered charity; subject to an undertaking that any valid proven claim subsequently received by the Principal Agent(s) from the beneficial or legal owner would immediately be met by the member‘s firm from its own resources. The transfer of such funds to a charity may require a note to the Principal Agent(s) business accounts of a potential liability to a future claim. Any such sums dealt with in this manner should form part of any disclosure to a future potential purchaser of the business.

1.45. Client Suspense Account after mergers etc.

Where any merger, acquisition, amalgamation etc. or similar takes place between a member’s firm and any other firm or company, any such funds held in the relevant Client Suspense Account as required under clause 1.42 above, should be transferred to the new company or firm with appropriate and sufficient information and, upon the member’s firm receiving a satisfactory written contractual undertaking that such amounts will, subject to a valid future claim, be refunded to the beneficial or legal owner. A member’s firm is advised to include in any contract of sale (or similar) an indemnity from the purchaser that any Client funds previously transferred, as a charitable donation, will be a liability of the purchaser.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 20

1.46. Non-compliance – breaches of the Accounting Rule

For the avoidance of doubt, Propertymark considers breaches of, or a failure to comply with, the general or specific requirements of the Accounting Rule as a serious matter that may result in significant sanctions being imposed and may jeopardise membership.

1.47. Tri-partite agreements for audits (PPD member’s firm – Accountants – Regulatory/Professional Body)

It should be noted that the requirement of a PPD member’s firm to provide a report under this Rule would not constitute a contract between the Accountants of the firm and Propertymark. A PPD member’s firm must take appropriate steps to include in its letter of engagement/contract with its Accountants a clause that permits a copy of any such report to be provided to Propertymark in order to comply with the Accounting Rule.

1.48. Client Account ‘HealthCheck’ in lieu of an Accountant’s Report

Qualifying PPD member firms (see clause 1.48.3 below) may satisfy their annual obligations to provide an accountant’s report by agreeing to a Client Account ‘HealthCheck’ undertaken by the Lettings Partnership. In doing so the PPD member firm agrees to provide specified information through an online form directly with the Lettings Partnership who will assess the PPD member firm’s compliance with accepted client accounting practice.

1.48.1. A PPD member firm must provide either an Accountant’s Report as specified in clause 1.26 or a ‘HealthCheck’ within the 6-month period following their financial year end as specified in clause 1.27. A HealthCheck must not be submitted before the PPD member firm’s year-end.

1.48.2. Should Propertymark be in receipt of a ‘HealthCheck’ assessed as ‘Refer’, Propertymark may seek further explanation(s) or undertake further investigations which may include compliance visits and/or accounts inspections to the PPD member firm.

1.48.3. PPD member firms may choose to undertake a ‘HealthCheck’ rather than submit an Accountant’s Report if they meet the following criteria:

a) At no stage during the financial year does the total amount held in the PPD member firm’s Client Account(s) exceed £1m. b) Client money held by a PPD member firm must only relate to residential lettings and management activities (excluding client money described in 1.11.3, specifically excluding holiday lets, block management, sales and auctioneering). c) The PPD member firms must not handle client money on behalf of any other legal entity. d) The PPD member firm must not use a CASP.

1.48.4. Propertymark reserve the right to withdraw the ‘HealthCheck’ facility at any time or to refuse the ability of a PPD member firm to choose the ‘HealthCheck’ option if there are valid concerns about the PPD member firm’s compliance with the Propertymark accounting rules, in either case reasonable notice will be provided in writing to the PPD member firm.

1. Accounting Rule (This rule does not apply to members of ARLA Inventories)

Members’ firms that are regulated by the Royal Institution of Chartered Surveyors (RICS), the Law Society or the Law Society of Scotland are exempt from the requirements of this rules.

1.1. Introduction to the Accounting Rule

1.1.1. The principles of this Rule shall apply to any PPD member’s firm that holds or handles Client Money or that has a contract with a Client and then outsources the Client Accounting to another organisation/legal entity.

1.1.2. These rules and the annexed Accountant’s Report or Accountant’s Report for Client Money Entrusted to an Unnamed Client Accounting Service Provider define the minimum level of accounting control required by a PPD where Clients’ funds are transacted by the business of that member. It is presented in a manner that anyone with a rudimentary knowledge of bookkeeping will find easy to comprehend. If complied with, it should be impossible for a member to confuse Clients’ Money with their own, or inadvertently to make improper payments.

1.1.3. In a partnership or company, all partners or directors share the responsibility of maintaining a proper bookkeeping system. Any misappropriation or error by one partner, director or a member of staff is the responsibility of every principal, partner or director. It is therefore incumbent upon all principals, partners and directors to satisfy themselves that any breach in the rules is rectified immediately.

1.2. Interpretation and definitions of some key terms used in Client Accounting

Accountant A suitably qualified or authorised person as detailed in clauses 1.24 and 1.25 of this Rule.

Accountant’s report The annual form duly completed and signed by the Accountant and provided to Propertymark.

Bank The Bank of England, the Post Office (in the exercise of its powers to provide banking services) or an authorised institution that has permission to accept deposits under the Financial Services and Markets Act 2000.

Building society As defined in section 119(1) of the Building Societies Act 1986 and is an authorised institution that has permission to accept deposits under the Financial Services and Markets Act 2000.

Client Any person or body for whom the PPD member’s firm or Client Accounting Service Provider holds or receives Clients’ Money (which may include a landlord or tenant, purchaser, vendor or contractor); including past, present and prospective Clients.

Client Accounting Service Provider (CASP)

A PPD member’s firm that manages Client Money on behalf of another PPD member’s firm. See clause 1.3 for a fuller definition.

Client (Bank) Account(s) A suitably designated and recognised current or deposit account at a bank or building society into which Clients’ Money is paid or transferred. (See clause 1.9 of this Rule.) (Sometimes called a pooled Client Bank Account.)

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 7

Client’s ledger Documents, journals, file cards, printouts – handwritten or mechanical or computer generated – which comprise a permanent chronological record of transactions and balances for an individual Client, at any time.

Clients’ Money Any money received or held by a member or PPD member’s firm or its Client Accounting Service Provider to which they are not beneficially entitled and over which there is exclusive control. See Clause 1.10 of this Rule for a more detailed definition.

Connected person/associate

A person is an associate of another if he or she is the spouse or a relative of that other or a business associate of that other. A relative is a brother, sister, uncle, aunt, nephew, niece, lineal ancestor or lineal descendant. References to a spouse include a former spouse and a reputed spouse. For the purposes of this subsection a relationship shall be established as if an illegitimate child or step-child of a person had been a child born to him or her in wedlock.

Office Account Any normal trading, business or office bank account opened or maintained by the member in which are held, or transferred, funds belonging to the member and/or from which outgoings incurred or due from the member, are paid; as distinct and separate from a Client Bank Account.

Payment(s) Any type or style of disbursement, withdrawal or transfer from a Client Bank Account.

PPD Member’s firm Firm (legal entity) under the control of any principal, partner, or director who is a member of ARLA Propertymark, NAEA Propertymark, NAVA Propertymark, ARLA Inventories or NAEA Commercial.

Principal Agent (PA) The firm or firms named in the contracts with the Client.

Reconciliation An analysis that identifies, on a given date, any differences between balances on Client ledgers against sums held in the Client Bank Account(s) and the Client Account Cash Book.

Records All documentation relating to the necessary operation and monitoring of the accounting/bookkeeping process in compliance with the rules of membership (including any bye-laws, rules of conduct, codes of practice including appendices of ARLA Propertymark, NAEA Propertymark, NAVA Propertymark, or NAEA Commercial).

1.3. Using a Client Accounting Service Provider (CASP) PPD member firms wishing to use a CASP are required to adopt one of the following two options: • Use a named CASP (see 1.3.1), or • Use a white label CASP service (see 1.3.2).

1.3.1. Use a named CASP. The following conditions apply:

(a) The CASP is a PPD member firm (excluding ARLA Inventories) or a RICS regulated firm where Propertymark receives written assurances from RICS that all Client Money is covered. (b) All Client Monies are paid direct to the Client Account(s) owned by the CASP.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 8

(c) All terms of business, landlord and tenancy agreements must clearly identify the legal names of the Principal Agents. (d) All terms of business, landlord and tenancy agreements must clearly identify the legal name of the CASP in all references to Client Money. (e) The CASP is the only firm to be able to make payments/withdrawals from the Client Account(s). (f) The CASP provides Propertymark with a standard annual accountant’s report for ALL the Client Money it handles. See Appendix A of the rules. (g) Both Principal Agents pay the Propertymark CMP levy.

In this way the CASP has exclusive control of the Client Account, and all Clients know who is handling their money. Liability to Clients remains with the CASP, and not with the firm using the CASP. This then constitutes first party Client Accounting by the CASP.

1.3.2. Use an unnamed CASP service. The following conditions apply:

(a) The CASP is a PPD member firm or a RICS regulated firm. (b) All Client Monies are paid direct to the Client Account(s) owned by the CASP. (c) The CASP is not clearly named in terms of business, landlord and tenancy agreements. (d) The legal name of the firm using the CASP (the Principal Agent) is clearly stated in terms of business, landlord and tenancy agreements. (e) All Client Monies are paid into a separate Client Account(s) designated to the PA PPD member firm, and owned solely by the CASP. (f) The CASP is the only firm to be able to make payments/withdrawals from the Client Account. (g) The PA and CASP both pay the Propertymark CMP levy. (h) The PA maintains records of all Client Monies in accordance with the relevant Propertymark rules. It may rely on schedules and reconciliations from the CASP but these should be kept in paper form. (i) The PA PPD member firm provides Propertymark with an Accountant’s Report for Client Money Entrusted to an Unnamed Client Accounting Service Provider on joining or on taking up the Client accounting service, and annually thereafter. See Appendix A to the rules. The report may be commissioned by the PA or CASP, but it remains the responsibility of the PA to provide it to Propertymark.

1.3.3. Any member’s firm acting as a CASP as outlined in 1.3.2 must meet the following requirements:

(a) Keep any such Client Money in a Client Account specifically designated to each PA for whom it handles Client Money. (b) Supply the PA with a copy bank statement from the Client Bank Account at least monthly. (c) Not limit the liability of the CASP to its PAs, or if there is any limitation it is, as a minimum, at least the amount the PA has entrusted to it. (d) Allow a suitably qualified Accountant to audit the CASP in respect of Client Money held on behalf of the PA.

1.3.4. PPDs with member firms using a CASP where the arrangements do not comply with one of the CASP options described in 1.3 must take one of the following actions in order to continue with their divisional membership:

(a) Change their Client Money-handling arrangements in line with one of the CASP options described in 1.3, or

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 9

(b) Find another CASP which complies, or (c) The member’s firm must handle all of its own Client Money.

1.3.5. Client Money subject to the Estate Agents Act 1979 must not be entrusted to a CASP.

1.4. General

Propertymark reserves the right to waive or modify, with or without conditions, in any particular case, the requirements and/or general provisions of this Rule.

1.5. Provision of this Rule to relevant staff and the reporting Accountant

It is the duty and responsibility of PPD members that this Rule is readily available to and understood by all principals, partners and directors etc. of a PPD member’s firm and, most essentially, by any staff responsible for operating the accounting process and procedures of that firm. A copy of this Rule together with Appendix A must be provided to the reporting Accountant prior to beginning an examination.

Member Firms must publish their client money handling procedures on their company website and, upon request, make hard copies available, free of charge, to all customers. To meet this obligation the following link to the Propertymark Conduct and Membership Rules, http://www.propertymark.co.uk/media/1045366/conduct-and-membership-rules.pdf should be added to the Member Firms website. The annual Accountant’s Report will require confirmation that this Rule has been met.

1.6. Key elements

1.6.1. The relevant membership division requires its members to comply with these rules in respect of their Client Accounts to ensure that Clients’ Money is protected. The key basic elements that must apply to Clients’ Money entrusted to a PPD member’s firm are as follows:

(a) Each transaction must be properly recorded in the PPD member’s firm’s books/ledgers of account (paper, electronic or otherwise) so that it is clearly identifiable to an individual Client. (b) Monies must be paid into a specifically designated Client (Bank) account with a recognised bank or building society and thus kept separate from the member’s firm’s own money. (c) All transactions must be monitored and reconciled on a regular basis.

1.6.2. Client (Bank) Accounts must be properly designated (see clause 1.9 below), easily identifiable and the individual beneficial owners of any money contained therein should be attributable, without difficulty, for the following main reasons:

(a) To prevent a bank or building society offsetting a credit balance in one account against a debit or charge incurred by another. (b) To enable a receiver or liquidator or other investigator to identify money that does not belong to the member or their business. (c) To allow such accounts to easily be monitored and reconciled both internally and externally to demonstrate the financial integrity of the member and to ensure the smooth running of its accounting practices.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 10

1.7. Access to, or availability of, Client Money

A member must ensure that, at all times, all Client Money is held in Client Bank Accounts and is available on demand to Clients without undue delay or penalty. (For the avoidance of doubt, Client Money must not be placed or held in off-shore accounts or fixed/variable rate term bonds or similar funds or arrangements, unless the bank or building society falls within the definitions in 1.2, funds are available on demand and any penalty for withdrawal is paid by the member’s firm.)

Note: Any penalty for withdrawal of Client Money must be limited to interest earned.

1.8. Client Money from members’ properties

A member must not conduct personal or office transactions through a Client Bank Account, save that it shall be permissible for the member to manage and collect rent on a property or properties belonging to any principal, partner, or director of the firm, so long as the number of properties involved are de minimis (no more than 5%), declared to and so recorded by the Accountant while completing the annual audit. It is permissible to hold tenants’ deposit monies relating to such properties in a Client (Bank) Account. This clause must be read in conjunction with clauses 1.10.2 and 1.11.1.

1.9. Title and conditions of a Client (Bank) Account

1.9.1. All members who receive, or may receive, deposits in transactions to which the Estate Agents Act 1979 applies shall open and operate a distinct Clients’ Account for that purpose in accordance with the requirements of that Act and with the Regulations made under it.

1.9.2. A PPD member’s firm that receives or holds Client money must maintain at least one Client (Bank) Account for this purpose.

1.9.3. Any such account(s) must include both the word “Client” and the legal name of the Principal Agent or CASP in the title.

1.9.4. The PPD member’s firm must hold on file in its records, written confirmation from any bank or building society where a Client (Bank) Account is held, that the following conditions apply to any such account(s):

(a) All money held in the account is Clients’ Money; and (b) The bank or building society is not entitled to combine the account with any other account or to exercise any right of set-off or counter claim against money in that account in respect of any sum owed to it on any other accounts of the member or the member’s firm.

1.10. Clients’ Money

Clients’ Money shall include the following:

1.10.1. Any money received or held by a member or PPD member’s firm or its Client Accounting Service Provider to which they are not beneficially entitled and over which there is exclusive control.

1.10.2. Money held in respect of properties owned jointly by a principal, or one or more partners, or directors, together with a person who is not a co-principal, co-partner or director of the member’s firm. (The member’s firm is considered a trustee for such money, which must be paid into a Client Bank Account.)

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 11

1.10.3. Payments or lodgements in respect of fees and/or disbursements received before these have been earned or incurred by the member’s firm, or passed on to a third party.

1.10.4. Tenants’ deposits passed to a Tenancy Deposit Scheme operating a custodial option under the provisions of the Housing Act 2004 in England and Wales and the Housing (Scotland) Act 2006 and the relevant regulations for such schemes. Examples of Client Money may include:

(a) Tenants' deposits (b) Rents (c) Interest (if in an interest-bearing Client Account), but see 1.12. (d) Arbitration fees (e) Fee money taken in advance (f) Clients' Money held but due to be paid to contractors (g) Money held by members appointed as a Receiver (h) Sale proceeds (i) Purchase deposits (j) Other money which is held on behalf of any Client related to the normal business of estate agency, letting agency, business agency, auctioneering and property management but excluding any money held for or in connection with investment, saving, banking, conveyancing or any mortgage.

1.11. Clients’ Money does not include the following:

1.11.1. Money (other than tenants’ deposits) received in respect of properties wholly owned by a principal, or by one or more partners or directors of the member’s firm.

1.11.2. Money held in an account from which a particular Client can separately make withdrawals and so over which the member’s firm does not have exclusive control. In the rare circumstances where such accounts are operated, the member’s firm must promptly confirm to the Client in writing (and retain a copy) that:

(a) The account is not a Client Account; (b) Such money is not covered by the Client Money Protection Scheme; and (c) The account is not monitored as part of the Client accounting compliance procedures.

1.11.3. For the purposes of Propertymark client account reporting, service charges and other client monies collected for block management and/or holiday let purposes are excluded. Client Money held for block management and/or holiday let activities are not regulated by Propertymark.

1.12. Interest on Clients’ money

1.12.1. A member’s firm may enter into an arrangement, which must be in writing (for example via terms of business, tenancy agreement, letter of engagement, pretenancy application documents or similar), with a Client (landlord or tenant) that allows the member’s firm to retain interest earned on money held on a Client’s behalf. (Such written arrangements/documents shall constitute part of the records as defined in this Rule.) Where no such arrangement exists, any interest earned belongs to the relevant Client.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 12

1.12.2. Subject to clause 1.12.1 above, where interest is credited to Client Bank Accounts of a member’s firm, the Client Account(s) should be organised in such a way that the member’s firm is able to account to each individual Client for the amount of interest earned or due to them.

1.12.3. A member’s firm holding Clients’ Money (in this context, tenancy deposit bonds) as stakeholder during a tenancy, is entitled to retain any interest that may accrue to such money (Potters vs. Loppert 1973), providing this entitlement is made known to the relevant Client(s), in writing, from commencement; i.e. in line with clause 1.12.1 of this Rule.

1.13. Payments into a Client (Bank) Account

Payment of money into a Client Bank Account is restricted to the following:

1.13.1. The minimum sum required to open or maintain the Client Bank Account;

1.13.2. Clients’ Money (see clause 1.10);

1.13.3. An amount required to be paid by a member’s firm to restore in whole or part any money paid out, or withdrawn, in contravention of this Rule;

1.13.4. A cheque or bank draft that includes Clients’ Money as well as other money.

1.14. Payments out of a Client (Bank) Account

A member’s firm should withdraw, transfer or make a payment from a Client Bank Account only in the following circumstances:

1.14.1. Money paid in to open or maintain the account in accordance with clause 1.13.1 of this Rule and where it is no longer required.

1.14.2. Money paid into the account in accordance with clause 1.13.4 of this Rule, which does not belong to the Client, for payment to the person lawfully entitled to it.

1.14.3. Within three working days of becoming aware of a relevant contravention, money paid into the account in contravention of this Rule.

1.14.4. Money payable to a Client, or, to an appropriate person suitably authorised (in writing) to receive such payments on that Client’s behalf.

1.14.5. Money being paid directly into another Client Bank Account.

1.14.6. Reimbursement of money to the member’s firm for money expended by the member‘s firm on behalf of the Client.

1.14.7. Money lawfully and contractually due, in respect of a PPD member’s firm’s fees and charges.

1.14.8. Legitimate disbursements, e.g. amounts subject to invoices, costs or demands incurred or received on behalf of the Client.

1.14.9. Provided that in the case of money drawn under sub-clauses 1.14.6 and 1.14.7 above:

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 13

(a) The payment is in accordance with lawful and contractual written arrangements (for example via terms of business, pre-contract/tenancy application documents, tenancy agreement, letter of engagement), previously agreed between the parties; or (b) The Client, or an authorised representative, has been notified or invoiced in writing by the member’s firm of the amount and purpose for which the money is being withdrawn and no objection has been raised within a reasonable timescale.

1.14.10. Provided always that, under rule 1.14, no payment shall be made for or on behalf of an individual Client that exceeds the total amount held on behalf of that particular Client.

1.15. Timing of banking

1.15.1. A member’s firm must bank all receipts of Client Money into an appropriate Client bank account within a maximum of two working days from the day on which it was received.

1.15.2. All payments out of a Client bank account should be made promptly, and within not more than 1 calendar month of becoming due.

1.16. Methods of payment from a Client (Bank) account:

Payment from a Client (Bank) account may be made by:

1.16.1. A cheque;

1.16.2. An electronic transfer to another bank or building society account, provided that such an arrangement does not constitute a direct debit transaction;

1.16.3. A bank draft;

1.16.4. Cash (in exceptional cases and where sufficient (staff) safety and (financial) security measures can, in the opinion of the member’s firm, be taken for the holding of such money prior to payment; the handing over of such money and, where sufficient records of receipt are obtained upon collection of the money).

1.17. Signatories to payments from a Client (Bank) Account:

1.17.1. To avoid undue delays or inconvenience to Clients or others entitled to receive payments, during any absence from the business, the principal, partner or director member must make adequate provision for designated personnel to be able to authorise and/or make appropriate payments.

1.17.2. A member’s firm has a duty of care to ensure that appropriate controls exist around the ability of any individual(s) to make payments from a Client Bank Account, including making online payments, and must maintain an up-to-date and accurate record listing, as a minimum:

(a) The full names of such persons; and (b) Any limits or restrictions governing the amounts for which that individual is authorised either exclusively or, jointly with others; and (c) An example or specimen signature of each person.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 14

1.17.3. The original of such a list or schedule should be lodged with the relevant bank or building society used by the member’s firm and a copy retained within the records of the member’s firm.

1.18. Record keeping (firms using a CASP; see also 1.3.2)

Each member’s firm must keep properly detailed accounting records, using a bookkeeping system that is adequately designed and operated. Such records need to record:

1.18.1. All Clients’ Money received, held or paid out by the firm;

1.18.2. The amounts, dates, names, property addresses, reference numbers and other relevant details to identify individual transactions;

1.18.3. Any other money dealt with through a Client (Bank) Account, attributable to individual Clients;

1.18.4. An individual Client’s balance of monies held, and a balance of all Clients’ Money held.

1.19. Books of record

All dealings referred to in clauses 1.18.1 to 1.18.4 above shall be recorded as appropriate, either:

1.19.1. In a Clients’ cash book, or in a Client’s column of a cash book; or

1.19.2. In a journal recording transfers from the ledger account of one Client to that of another;

1.19.3. And, in either case, additionally in a Clients’ ledger or in a Client’s column of a ledger.

1.20. Supporting documentation

Records must include a list of all persons for whom a member’s firm is or has been holding Clients’ Money, reconciliation documents, and a list of all the bank and building society account(s) in which the money is held and must include counterfoils or duplicate copies of all receipts issued in respect of Clients’ Money received, which shall contain the particulars required to be shown in the accounts.

1.21. Preservation of records

The records kept for the purpose of complying with this Rule must be preserved for six years from the end of the accounting period to which they relate, or from when the account shows a nil balance following a cessation of the contractual relationship between the parties, whichever is the later. Propertymark recommends that a member’s firm consult with their Accountant before disposing of, or destroying, any historic accounting records.

1.22. Computerised recording

Where a computerised bookkeeping system is in operation, this must be capable of producing printed information to conform to this Rule, which therefore is or can be preserved in a permanent format to comply with clause 1.21.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 15

1.23. Reconciliation(s) – format and frequency

1.23.1. Every member’s firm shall:

(a) Ensure all monies due to member firm are removed prior to final reconciliations being undertaken. (b) At least once every two calendar months (and within no later than ten weeks of a previous reconciliation), reconcile the balance on their Client’s cash book(s): (i) With the balance in their Client Bank Account(s) using the bank/building society statement(s); and (ii) With the total of each Client’s balance in the Clients’ ledger; and (c) Ensure that such documents necessary to support the reconciliation so produced have been kept safe, complete and readily available in the cash book or other appropriate place.

1.23.2. All such reconciliations should be checked and signed by the PPD member of the company, or by such person formally appointed by the PPD, who shall not be the person responsible for the preparation of such reconciliation. (This could be a member of staff of the appointed reporting Accountant, provided this is carried out within ten working days of the reconciliation.)

1.23.3. Reconciliations must be stored so as to be readily available at audit or inspection, in accordance with 1.21.

1.24. Qualifications of Accountants

An Accountant is disqualified from making a report under this Rule if, at any time between the beginning of the accounting period to which the report relates and the completion of the report, the reporting accountant shall be a connected person to any principal, partner or director of the member’s firm (whether Principal Agent or CASP) or to any member of the staff employed by the member’s firm in the preparation of the Client Accounting records. The Accountant must be a member of a relevant professional body and, where the Client funds held are subject to the Estate Agents Act 1979 must be a registered auditor as per section 1239 of the Companies Act 2006.

1.25. Eligibility of Accountants

1.25.1. Where this clause does not conflict with clause 1.24 above, an Accountant is eligible and qualified to give an Accountant’s Report for the purposes of this Rule if he or she is a member of any of the following:

• Institute of Chartered Accountants in England and Wales • institute of Chartered Accountants of Scotland • Chartered Accountants Ireland • Association of Chartered Certified Accountants

and has a practising certificate from one of the aforementioned bodies, required to undertake such work, where applicable.

1.25.2. And also, if the agent carries out transactions regulated by the Estates Agents Act 1979:

• An individual who is a registered auditor within the terms of Section 1239 of the Companies Act 2006; or • An employee of such an individual; or

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 16

• A partner in or employee of a partnership that is a registered auditor within the terms of the Companies Act 2006; or • A director or employee of a company that is a registered auditor within the terms of the Companies Act 2006; or • A member or employee of a limited liability partnership under the Limited Liability Partnership Act 2000 that is a registered auditor within the terms of the Companies Act 2006.

1.26. Accountant’s report – timing and format (see clause 1.48)

Once in every period of twelve months each member‘s firm shall cause to be prepared and delivered to Propertymark an Accountant’s Report or Accountant’s Report for Client Money Entrusted to an Unnamed Client Accounting Service Provider on behalf of the member’s firm, as appropriate. (See Appendices A and B to the rules).

1.27. Submission of report or HealthCheck

The report referred to in this Rule must be submitted to Propertymark by the member’s firm no later than six months after the end of the accounting period to which it relates (if completing the HealthCheck, please ensure information is supplied to The Letting Partnership, allowing sufficient time to ensure the final report or HealthCheck is received by Propertymark in accordance with this rule).. Late submission of Accountant’s Reports may be pursued as a disciplinary matter. Such matters will be dealt with outside of the disciplinary procedures. In these circumstances members may not have an opportunity to explain the reasons for their delay. Instead, late submission is likely to result in an automatic fine of up to £200 per breach of every separate requirement. Failure to provide an Accountant’s Report within twenty eight days of the deadline will result in termination of all memberships of all PPD members responsible for the firm. This timescale may be altered with prior arrangement of Propertymark.

1.28. The relevant accounting period

The relevant accounting period:

1.28.1. Shall cover not more than twelve months*;

1.28.2. Shall begin at the expiry of the last preceding accounting period for which a report under this Rule has been submitted to the Propertymark; and

1.28.3. Shall, where possible, correspond to a period or consecutive periods for which the accounts of the member’s firm or CASP are ordinarily made up.

*Except where otherwise agreed by Propertymark (for instance, to allow for a change in yearend accounting date); in such circumstances Propertymark may at its discretion request additional information in order to be satisfied of the continuing compliance of the member’s firm.

1.29. Change of accounting period

A change of the accounting period of a member’s firm must be notified to Propertymark at least one month before the end of the originally notified accounting period.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 17

1.30. Reporting when no Client’s Money has been held

Where a member’s firm has a Clients’ Account or uses a CASP but no Client’s Money has been held during the relevant period, a report shall be completed, by the Accountant, to this effect.

1.31. Where a member is a PPD of more than one firm

Where a member is a principal, partner or director of more than one firm, a separate report for each firm must be submitted.

1.32. More than one place of business

Where a member’s firm has more than one place of business, one or more report(s) may be submitted in respect of the business, provided that the report(s) cover(s) all Clients’ Money held, received or paid out by the member’s firm.

1.33. More than one CASP

Where a member’s firm uses more than one CASP, then the requirements must be met for each CASP.

1.34. Accountant’s Report – scope and content

It is the duty of each member’s firm to provide to their Accountant at appropriate times (usually this would be both at the point of agreeing their terms of engagement and at the time of the audit visit):

1.34.1. An up-to-date copy of this Rule, together with

1.34.2. The Accountant’s Report (Appendix A), which must be submitted to Propertymark in due course with each page signed and dated by the reporting Accountant.

1.35. Special requirements

1.35.1. New PPD firms that have started trading with a Client (Bank) Account nil balance, and have not yet had an accounting year end, are required to submit immediately an Accountant’s Report. See Appendix A to the rules.

1.35.2. PPD member’s firms that begin to use an unnamed CASP as described at 1.3.2 are required to submit immediately an Accountant’s Report for Client Money Entrusted to an Unnamed Client Accounting Service Provider on behalf of the member’s firm.

1.35.3. New PPD applicants and current PPD members whose newly acquired company inherited a Client (Bank) Account balance, or whose company has already had an accounting year end, will need to submit immediately an Accountant’s Report for the company’s last financial year.

1.35.4. For business transfers, company purchases, or changes in company type, or if it is unclear what Client Account reporting is required, a PPD member must seek instruction from Propertymark.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 18

1.36. Client accounting compliance check visits and investigations

Reason/rationale for such visits/investigations: In order to comply with obligations placed on Propertymark under its Client Money Protection Scheme and its duty to both its own membership and the public to robustly monitor compliance with Accounting rules, Propertymark may, at any time, carry out or authorise a visit or inspection as part of the random spot checks carried out by Propertymark from time to time upon a member’s firm(s) or as a result of information coming to the attention of Propertymark.

1.37. Notification of such visits/investigations

The relevant selected member’s firm will be provided with at least a minimum of ten working days’ notice of the intention to carry out such a visit.

1.38. Duty to co-operate and provide information/records

It is a condition of membership that a member’s firm co-operates with such a visit or inspection and, in this regard, will be required to produce or make available, at a time and place duly notified, such records and documents (howsoever maintained or stored) as necessary for inspection and review by a person appointed by Propertymark, in order that a report on compliance may be produced. CASPs must ensure that their terms of business allow Propertymark access to their Client Account records for inspection visits or audit purposes.

1.39. Scope of visits

Such visits or investigations may or may not comprise an audit (insomuch as this term applies to compliance with this Rule) and may or may not be restricted to an assessment of the systems, procedures and controls operated by the member’s firm with regard to the Accounting rules.

1.40. Liability for costs of such visits/inspections

If, following such a visit or inspection carried out under this Rule, the member’s firm is found to have contravened or breached the relevant rules, Propertymark reserves the right to require the member’s firm to pay an amount, which shall be no more than the total costs, towards the expenses and/or expenditure incurred by Propertymark in carrying out such a visit and/or investigation. (For the avoidance of doubt, this amount shall be separate from any other fine or sanction imposed by the Propertymark or Disciplinary Tribunal for a contravention or breach of the rules.)

1.41. Ongoing liability to co-operate after membership ceases

Where membership ceases (for whatever reason) and Propertymark has cause to believe Propertymark may be, or may become, liable to a claim under the Propertymark Client Money Protection Scheme, that member and their firm shall have an ongoing liability to provide full access to the Propertymark or its representatives in relation to this Rule.

Propertymark Conduct and Membership Rules V.01.01.2018 Page | 19

1.42. Old or dormant Client balances